Data collection and personalization are ubiquitous today, raising concerns of privacy and price discrimination. In response to these concerns, both regulatory authorities and the market emphasize the value of consumer control. In the public sphere, the European Union’s GDPR and California’s Consumer Privacy Act require websites to obtain consent before collecting browsing information and restrict the duration that consumer data can be retained. In the private sphere, Apple, Google, and other firms have rolled out product features that allow consumers to opt out of personalized tracking.

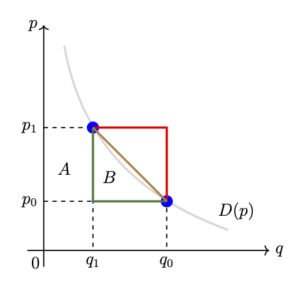

Although consumer control features prominently in discussions of privacy policies, relatively little is known about how to model consumer control and its effects on market outcomes. If consumers control the information possessed by sellers, is price discrimination beneficial? Or should it nevertheless be prohibited? Does it suffice for the consumer to be able to opt out from sharing information or is control at a more granular level needed? How does this relate to market competitiveness? Clearly, a strategic framework is necessary to assess the implications of privacy policies.

Our work (Ali, Lewis and Vasserman, 2022) offers such a framework. We view consumer control through the lens of voluntary disclosure. The consumer has certain verifiable characteristics—her age, income, or her data—that are correlated with her preferences. Rather than sellers having this information at the outset, the consumer chooses what to disclose to the market. From this perspective, opting in to a firm’s tracking policy is tantamount to disclosing data predictive of her preferences; opting out, by contrast, corresponds to choosing not to disclose information. These are but two choices; one may envision contexts that endow the consumer with control at a more granular level—e.g., the ability to disclose a student ID or a senior citizen card—without having to opt in entirely. In equilibrium, firms do not take disclosed information at face value; instead, they draw inferences both from what is said and what is left unsaid.

We use this framework to answer the questions above. In monopolistic markets, consumers do not benefit from personalized pricing if the only choice they have is to opt in or out from sharing information; more fine-tuned control is necessary for them to benefit from personalized pricing. By contrast, if the market is competitive, control even in the form of simple opt-in / opt-out policies are enough to assure consumer gains. Disclosure amplifies competition. Contrary to the view that firms should not price discriminate, our findings suggest that consumers may benefit from price discrimination if they control the flow of information.

We describe these findings in greater below and also pose new questions for which our approach may be useful.